The world’s most valuable brands have experienced record growth according to the Kantar BrandZTM Most Valuable Global Brands 2021 ranking, with the total worth reaching $7.1 trillion –equivalent to the combined GDP of France and Germany. The42% increase; more than four times the study’s annual average percentage increase over the past 15 years, has been driven by confidence derived from vaccine availability, economic stimulus packages and improving GDP outlooks. US brands account for 56of the Top 100 brands, with Amazon and Apple leading the way – each now worth over US$½ trillion.

“Powerful brands have always provided marketers with strong returns, even during times of business as unusual caused by the pandemic. Despite the strong headwinds caused by COVID-19, we clearly saw that brands that invested in knowing and understanding their consumers’ evolving needs, and addressing them, did well. These brands made sure they remained meaningful in the evolving context, which by default ensured consumers continued to choose them over competition. We also see that brands that continue to meaningfully differentiate themselves, and amplify that meaningful difference by communicating with consumers, sustain strong performance and grow even in difficult times. And that is the power of brand building,” commented Amol Ghate, CEO Middle East, Insights Division, Kantar.

Key trends highlighted in this year’s Kantar BrandZ Most Valuable Global Brands study include:

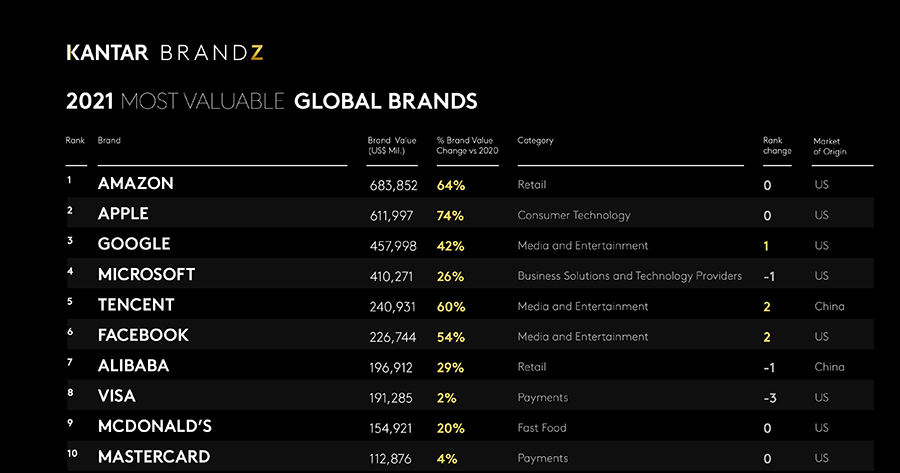

- Amazon maintained its position as the world’s most valuable brand, growing 64% to US$684bn (or the equivalent GDP of Poland). Having first entered the BrandZ ranking in 2006, Amazon’s value grew by almost $268bn this year and became the first half-a-trillion-dollar brand, joined by Apple, valued at $612bn.

- Tesla is the fastest growing brand and became the most valuable car brand, growing its value by 275% year-on-year to $42.6bn

- Five brands more than doubled their brand values: Pinduoduo, Meituan, Moutai and TikTok from China, and Tesla from the USA.

- Overall growth has been fuelled by 69brands increasing their value by at least 5% since 2020, together with 13 new entrants, including Zoom, Nvidia and AMD, and Spotify.

- Technology dominates the top end of the Kantar BrandZranking, with seven of the top ten brands coming from the tech sector. Tech has also enabled non-tech brands to achieve significant growth, for example Gucci – harnessing the power of TikTok during the pandemic, and Domino’s – leveraging online and delivery services. The Top 10brands are today valued at $3.3 trillion, compared to$800 billion in 2011.

- US brands grew fastest in 2021 with their brand values growing an average46%year-on-year, meaning the US now accounts for 74% of the Top 100’s total value, despite having just 24% of global GDP.

- China has consolidated its lead over Europe. Chinese brands have grown from 11% of the Top 100 value in 2011 to 14% today. European brands, in contrast, now represent 8% of the ranking’s value versus 20% in 2011.

| Rank 2021 | Brand | Brand Value 2021 ($Mil.) | % Change 2021 vs 2020 |

| 1 | Amazon | $ 683,852 | 64% |

| 2 | Apple | $ 611,997 | 74% |

| 3 | Google | $ 457,998 | 42% |

| 4 | Microsoft | $ 410,271 | 26% |

| 5 | Tencent | $ 240,931 | 60% |

| 6 | Facebook | $ 226,744 | 54% |

| 7 | Alibaba | $ 196,912 | 29% |

| 8 | Visa | $ 191,285 | 2% |

| 9 | McDonald’s | $ 154,921 | 20% |

| 10 | MasterCard | $ 112,876 | 4% |

| Kantar BrandZ Top 10 Most Valuable Global Brands 2021 |

“2020-1 has been a record year for brand growth, and despite many facing a difficult year, our research has again proven that strong brands deliver superior shareholder returns, are more resilient and recover more quickly,” comments Nathalie Burdet, CMO of Kantar. “With global ecommerce growing from 12% to 15% of all sales in 2020, it has been a positive year for brands involved in that value chain – from the retailers through to the couriers like FedEx and UPS. However, we have also seen growth in industries where many were predicting challenges early in the pandemic. Apparel brands for example have collectively grown even more than media and entertainment brands in the ranking, and luxury brands, despite reduced travel and lockdowns globally, have refocused their energies and seen growth as a result.”

Across industries, brands have been rewarded for meeting consumers’ changing needs and behaviours:

- As consumers spent more time at home during lockdown, the Kantar BrandZ Top 10 Media and Entertainment Brands experienced impressive growth (+50%). The technologies behind gaming, chip providers Nvidia and AMD, entered the ranking for the first time.

- The Media and Entertainment space was overtaken by the Apparelcategory with value growth of 53%, as people redefined the boundaries between work and leisure wear. This was driven by athleisure, with Adidas, Nike, Puma and Lululemon all securing 50%+ value growth. Whilst, collectively, fast fashion did not grow as fast, although,notably, Uniqlo (+88%) and H&M (+47%) grew valuations significantly.

- As more of the world turned to online shopping during the pandemic, the Top 20 retailers grew their brand value by a combined 48%. Beyond Amazon’s success, Chinese ecommerce brands showed strong growth; Alibaba,#7 in the global ranking consolidated its position as the second most valuable retail brand, and Pinduoduowas the fastest growing retail brand. The ecommerce giants are not the only retail winners: The Home Depot saw 22% value growth thanks to online sales growth of 86%1, while Walmart grew its value by 30% and Lowe’s 51%.

- New entrant Zoom was one of the big tech stories of 2021, with its ease of use and reliability driving momentum with business and personal users. It entered the ranking at 52 with a valuation of $9bn.

- Subscription models have been a significant driver of success for many. Microsoft is one of the best examples of this (+26%) innovating offers to adapt to new working environments and transitioning to subscription models to improve convenience and scalability. Xbox (+55%), Disney (+13%) and Netflix (+55%) all saw growth, while Spotify entered the ranking following a 454% growth in subscribers from 2015-20 and a significant improvement in consumer brand equity. Beyond technology, subscription-based models are also increasing the value of a broad range of brands including Lululemon, Nike, Mercedes-Benz and Heineken.

- Alcohol maintained its growth throughout the pandemic, fuelled by Chinese Baiju brands. The most valuable alcohol brand in the world is Moutai ($109.3bn)– which doubled its valuation in one year and is now four times the size of Budweiser (with the second biggest alcohol valuation of $25.5bn). Heineken was the fastest growing beer brand growing 16% (#4 in alcohol ranking).

Reputation, especially for sustainable and ethical purposes, is increasingly a driver for brand growth. The luxury category saw 34% brand growth with, predominantly, French and Italian luxury companies such asLVMHinvesting in their corporate reputation through pandemic-related initiatives, sustainable transformation, and support for social movements such as BLM. Similarly, L’Oréal Parissuccessfully bucked the trend across beauty brands in the pandemic, securing brand growth by flexing its assets and driving female empowerment.

“This year’s results show that brand building remains critical to securing growth,” explains Burdet. “We track the stock market performance of our strongest brands and have seen these recover twice as fast as other key indices. Our analytics have uncovered that 70% of what makes a brand successful is executing four fundamentals well: providing superior experience across consistently branded touchpoints, a range of well-designed and functional products and services, convenience, and exposure through great advertising. However, COVID-19 has emphasised consumer values such as trust and reliability. Those brands that are evolving their values, projecting leadership on these issues are demonstrating differentiation and standing out.”