According to the EY Future Consumer Index, 69% of consumers in the MENA region believe that the way they live their lives will significantly change in the long term as a result of the COVID-19 pandemic.

From the start of the pandemic, 84% of consumers declared that they have changed the products they buy with a greater focus on value for money, and an increased commitment to consume locally made products. Many consumer segments in the MENA region are adopting such values for the first time, with 68% saying that their values have changed, and they look at life differently. This will have implications for what and how they consume in the future.

For example, consumers expect to make deep and lasting changes, with 78% saying they will be more aware and cautious about physical health. In addition, 73% will be more focused on value for money in the future, with 67% planning to decrease the amount they spend on non-essentials.

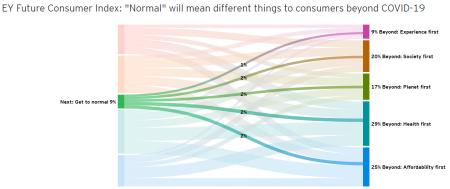

MENA consumers do plan to remain frugal and keep cutting their spend, far more than global consumers, with only 9% planning to “get back to normal” — versus 40% globally. While there has been a general ease of restrictions across some countries in the region, many consumers are still uncomfortable returning to their pre-COVID activities. For instance, only 26% of MENA consumers are comfortable going to a mall.

Ahmed Reda, MENA Consumer Industry Leader, EY, says:

“One of the many things that both organizations and individuals have learned from the shared experience of the pandemic is how resourceful and adaptable they can be. Now attention is turning to what the world might be like once the crisis is behind us. While companies can’t forecast with certainty what consumers will be doing 18 months from now, they will need to anticipate the consumer requirements and values they will be trying to serve.”

“As consumers re-evaluate their approach to personal consumption and adopt new habits, preferences, and attitudes for the future, companies will also need to ensure that their products meet expectations to either maintain or brand loyalty. This will have a pivotal impact on consumption patterns and consumer identities over the next few years.”

Consumers will be prioritizing health and affordability beyond COVID-19

The EY Future Consumer Index, a monthly poll that tracks consumer sentiment and behavior across the world, surveyed 1,018 consumers from the Kingdom of Saudi Arabia and the United Arab Emirates. The questionnaire found that five distinct segments can describe consumer behavior beyond the COVID-19 pandemic: ‘health first’, ‘affordability first’, ‘society first’, ‘planet first’, and ‘experience first’.

Of the consumers surveyed, 29% said that their biggest priority was to protect their health and the health of their family, which will guide the choices that they make. They prefer brands and products that they trust to be safe and will minimize unnecessary risk as much as they can. For example, they would rather shop online than in store because it feels safer. Moreover, 64% have increased spend on household products and home hygiene, while 57% would pay more for products that promote health and wellness.

The second largest segment of consumers at 25% put affordability first as part of their decision making. They focus on living within their means and don’t care much about the brands they buy but that the product delivers what they need. The 74% of affordability first consumers have identified price as increasing in importance, while 21% think it will take years for their financial stability to reach pre COVID-19 levels.

For 20% of MENA consumers, putting society first is their biggest priority. They pay attention to the social impact of what they purchase and consume as well as look for brands that have a clear purpose and align with their own values. In putting society first, 60% of these consumers will be more attentive to the social impact of what they consume for the long term, while 51% will support domestic brands produced locally for the long term.

Also focusing on social impact are the 17% of consumers who will take a ‘planet first’ approach to consumption choices, with 40% willing to pay more for sustainable products. Lastly, 9% of consumers will be taking an ‘experience first’ approach to life beyond COVID-19 and are intent on living in the moment, with 58% comfortable with going to the mall just days or weeks after the pandemic and 30% willing to pay a premium for luxury food and drink items.

Organizations need to plan for the consumer of tomorrow

To meet the changing demands of the market, the leaders of consumer-facing organizations need to ensure that their businesses have the portfolio, brand experience, and transparency that consumers will trust.

To protect the business and grow, leaders will have to prioritize reshaping their company’s portfolio so that it is relevant to the future consumer as well as provide digital customer journeys that reflect the way consumers will behave.

In addition, leaders must offer the transparency and communication that is needed by consumers in order to secure their trust.

Ravi Kapoor, MENA Consumer Industry Consulting Leader, EY, concludes:

“Over time, we expect concerns around health and household to diminish as people, communities, and economies recover – but they won’t go away entirely. As consumers let new priorities and circumstances guide their shopping habits, organizations will be required to consider efficiency against the need to keep developing the capabilities that will lead to growth.”

“Many organizations responded to the COVID-19 crisis with a degree of speed and innovation they probably wouldn’t have thought possible a few months ago. But they still need to work out how to serve a more health-conscious and value-conscious consumer. While some believe they already have the right portfolio, marketing, and supply chain in place, few are resilient enough to deliver against these heightened expectations. Furthermore, investors and other stakeholders have become much more interested in whether a company’s behavior lives up to its promises, vague assurances will no longer be enough.”