Although there is greater emphasis on corporate social responsibility and a widespread use of new technologiesin the commercial real estate industry, the biennial proprietary Global Real Estate Transparency Index published by JLL and LaSalle (NYSE: JLL) shows the slowest rate of transparency improvement since the period directly following the Global Financial Crisis.

Increasing standards in sustainability

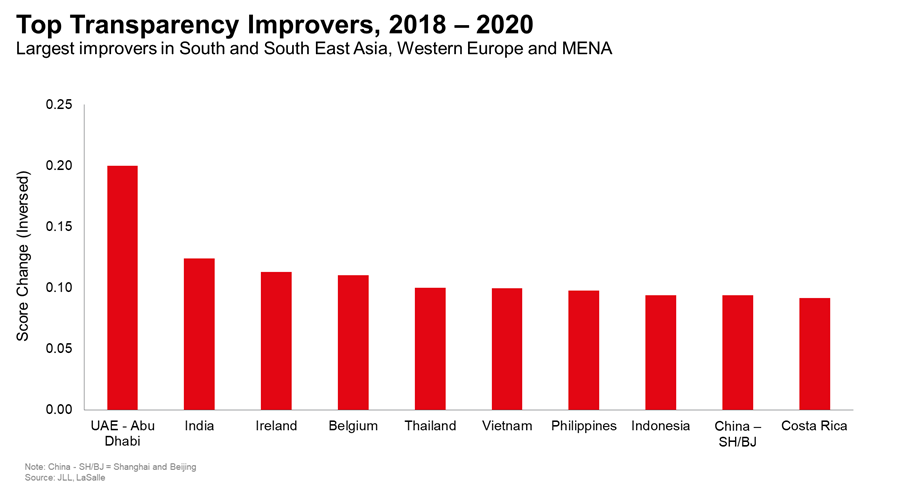

Top-performing “Highly Transparent” markets, including the UK, U.S., Australia and France, are driving higher standards in sustainability. For example, France and Australia lead on sustainability transparency as the first adopters of new initiatives such as water efficiency standards and resilient building frameworks. Countries that made the greatest improvements in their rankings are undertaking similar efforts. For instance, Abu Dhabi’s score was boosted by government initiatives to improve corporate and real estate sustainability, Costa Rica has seen gains underpinned by continued improvements in sustainability standards and Belgium has been helped by new requirements for large companies to implement climate action plans.

“Sustainability commitments have become the biggest single driver of real estate transparency globally since 2018,” said Jeremy Kelly, Director, Global Research, JLL. “As companies demonstrate an unwavering commitment to corporate social responsibility, there is increased voluntary adoption of Environmental, Social and Governance (ESG) measures and greater acknowledgement of the need to create a sustainable built environment.”

Growing adoption of proptech platforms

Another key driver of transparency is the volume of real estate data now available due to the growing adoption of property technology (“proptech”) platforms, digital tools and “big data” techniques. Research for the Global Real Estate Transparency Index was gathered in the early days of the COVID-19 crisis. Although real estate markets have historically faced challenges when implementing new technology, the pandemic is leading to an acceleration in new types of non-standard and high-frequency data – especially relating to health, mobility and space usage – being collected and disseminated in near-real-time.COVID-19 could fast-track digitization and stimulate innovation in the use of technology due to the need for accurate and just-in-time data.

The highest levels of proptech adoption are in the “Highly Transparent” markets, such as France, Netherlands, Australia, UK, Canada and the U.S., as well as the high-income Asia Pacific markets like South Korea, Singapore and Hong Kong SAR. Significantly, several less transparent, larger emerging markets also stand out on proptech adoption – including India, South Africa, Brazil and Mainland China.

Most improvement seen in Asia

South and Southeast Asian markets have led transparency advances in this year’s survey. India has made greatest progress in the region with advancement in the country’s REIT framework attracting greater interest from institutional investors. India has also edged into the top 20 for sustainability transparency and is actively rolling out sustainability regulations and standards.

Thailand, Vietnam, the Philippines and Indonesia have also seen improved transparency, making their real estate markets gradually more investible. In particular, Thailand and Vietnam’s top cities have moved into the “Transparent” and “Semi-Transparent” tiers respectively.

Mainland China is one of this year’s top improvers with Shanghai and Beijing moving into the “Transparent” category for the first time. China’s leading cities have seen the greatest improvement in transparency globally over the past twelveyears and are now reaping the benefits with Shanghai regularly appearing among the world’s top five cities for cross-border investment. Supporting transparency momentum is a burgeoning proptech sector, wider adoption of sustainability certification and better co-ordination of land use planning.

With growing pressure from investors, businesses and consumers, real estate transparency will need to improve further and faster to compete with other asset classes and meet heightened expectations about the industry’s role in providing a sustainable, resilient and healthy built environment.

“With innovation in the use of new technologies now becoming more widespread, coupled with an evolving regulatory landscape, in part due to the COVID-19 pandemic, it will be crucial for the real estate industry to work more collaboratively with governments and civil society to achieve greater transparency,” Kelly said.