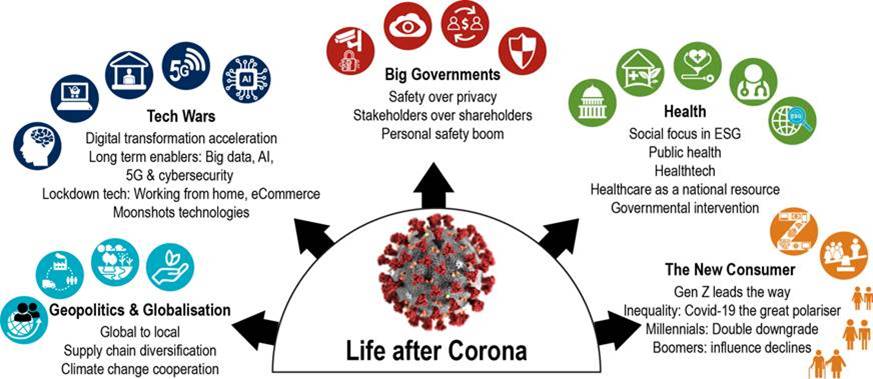

A new world order post-Covid: bigger governments, tech wars, safer but less private societies, health the new wealth

· We highlight 5 key trends that are accelerating to shape the world to come with a survey of BofA analysts

· $20tn enablers after the Great Isolation, +ve: health, ESG, staples, tech, -ve:fossil energy, autos, sharing economy

"The Day After Tomorrow"

Covid-19 is one of those rare events in history – like the Great Depression and fall of the Berlin Wall that will completely reshape geopolitics, societies, and markets. It is likely to be a catalyst for further tectonic shifts in the US & China decoupling, peak globalisation of supply chains and central bank quantitative failure. The consequences could be far-reaching, ranging from social unrest to further instability in oil, new economic doctrines, and re-evaluation of the social contract in sovereign states.

Post-Covid: times they are a-changing in the world order

Data is being created at the fastest rate ever, already up 50% vs. pre-Covid in parts of the west. The effect is intensifying the tech war, with governments becoming bigger and more influential – the Fed printed US$1mn every second at peak panic. Societies will be safer but less private, with more than 30 countries issuing citizen tracking orders.

5 themes and best/worst placed after the Great Isolation

Alongside a global survey of BofA analysts covering 3,000 companies and spanning 25 sectors, we outline 5 themes with US$20tn market cap of enablers for the world post-Covid. Among the secular beneficiaries are healthcare, digital consumer, ESG, staples, industrial real estate, and technology. Some of the challenged sectors include: fossil energy, commercial real estate, autos, legacy consumer, and the sharing economy:

1. Geopolitics & Globalisation – the dragon vs the eagle, round II: rising tensions clashing East/West doctrines. ‘Global to local’ on fast-forward. A third of BofA analysts now expect their companies to push for supply chain reshoring.

2. Tech War – the race for supremacy: data is the new must need resource, meaning a resurfacing tech-war as the new geopolitical battleground. Half of our analysts expect higher IT spending than pre-Covid. We anticipate a wave of investment in new infrastructure, AI technologies and moonshot future tech.

3. Big Government – a new social contract: the state has a new economic & social mandate. A third of analysts expect some erosion of shareholder rights = rise of stakeholders. Government ‘data fever’. Privacy will be the currency to buy safety.

4. Health – the new wealth and focus for ESG: public health is the new national wealth. Stakeholders will increasingly focus on health-related ESG metrics; governments will come to appreciate health more as an economic resource.

5. The New Consumer – "OK, Zoomer": Gen Z is uniquely prepared for the new era of social distancing, the online world, and sustainability. Other generations will be slow to adapt. Millennials, the "double downgrade" generation, is most exposed to earning cuts as more US jobs have been wiped out this past month than have been created since the great financial crisis. EM middle class growth will stall.