Refinitiv released the Middle East and North Africa investment banking analysis for the first nine months of 2020. According to the report, investment banking fees generated in the Middle East and North Africa reached an estimated US$895.7 million during the first nine months of 2020, up 4% from the same period in 2019 to the highest year-to-date total since 2008. US$361.4 million worth of advisory fees were earned from completed M&A transactions in the region during the first nine months of 2020, up 23% from last year to the highest year-to-date total since our records began in 2000.

Debt capital markets underwriting fees also increased from last year, up 2% to US$211.7 million, the second highest year-to-date total since our records began. Meanwhile, equity capital markets underwriting fees declined 20% to US$44.6 million, marking the lowest first nine-month total for equity fees in the region in four years, and syndicated lending fees fell 8% to a five-year low of US$278.0 million. Government & Agency fees accounted for 35% of total investment banking fees earned in the region during the first nine months of 2020, up from 24% during the same period last year.

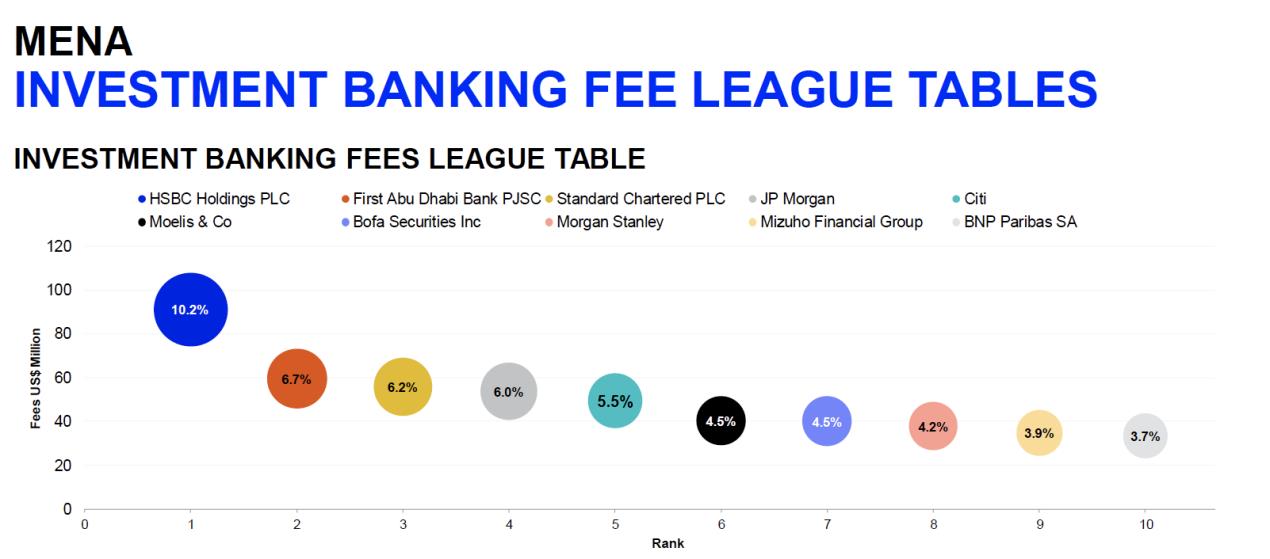

The United Arab Emirates generated the most fees, a total of US$361.0 million accounting for 40%, followed by Saudi Arabia with US$268.3 million. HSBC earned the most investment banking fees in the region during the first nine months of 2020, a total of US$91.1 million or a10% share of the total fee pool.

MERGERS & ACQUISITIONS

The value of announced M&A transactions with any MENA involvement reached US$58.0 billion during the first nine months of 2020. It marked the third highest year-to-date total of all-time, despite falling 52% in value from the record high achieved last year with Saudi Aramco’s agreement to buy a stake in Saudi Basic Industries Corp for$69.1 billion.

About US$6.3 billion worth of deals were announced during the third quarter of 2020, down 82% from the previous quarter which was boosted by two mega deals -Saudi Arabia’s National Commercial Bank announced plans to acquire Samba Financial Group for US$15.6 billion and a consortium of investors agreed to buy ADNOC gas pipeline assets for US$10.1 billion.

Despite scoring the second highest first nine-month total of all-time, domestic M&A registered a 71% decline from last year to US$25.2 billion, again due to the Aramco / Sabic deal. Inbound M&A, involving an acquiror from outside of the region, increased 36% to an all-time year-to-date high of US$22.5 billion, while outbound M&A declined 47% to US5.0 billion.

The financial sector was most active, with deals targeting financial companies accounting for 40% of total M&A in the region during the first nine months of 2020, followed by Energy & Power with 21%. Saudi Arabia was the most targeted nation, followed by The United Arab Emirates and Egypt.

Morgan Stanley topped the any MENA involvement announced M&A financial advisor league table during the first nine months of 2020 with a 45% market share.

EQUITY CAPITAL MARKETS

MENA equity and equity-related issuance totaled US$2.6 billion during the first nine months of 2020, 7% less than the value recorded during the same period last year and a three-year low after less than US$80 million was raised during the second quarter.

Third quarter issuance reached US$1.7 billion as Abu Dhabi National Oil Co sold US$1 billion worth of shares in ADNOC Distribution, and Dubai-based social networking and entertainment platform Yalla Group raised US$139.5 million through its New York listing. First Abu Dhabi Bank PJSC takes first place in the MENA ECM league table during the first nine months of 2020, followed by Citi.

DEBT CAPITAL MARKETS

MENA debt issuance reached US$92.4 billion during the first nine months of 2020, up 8% from the value recorded during the same period in 2019 and an all-time year-to-date high. After a strong start, with over US$9 billion raised in both January and February, March issuance slowed to just US$572.0 million.

About US$52.4 billion was recorded during the second quarter of 2020, an all-time quarterly high in the region, followed by US$20.5 billion during the third quarter. The United Arab Emirates and Saudi Arabia were the most active issuer nations during the first nine months of 2020 with US$34.7 billion and US$21.9 billion in bond proceeds, respectively. Standard Chartered took the top spot in the MENA bond underwriter ranking during the first nine months of 2020 with US$16.5 billion of related proceeds, or an 18% market share.